Why Insurance Denies Ozempic, Wegovy, Mounjaro

Insurance often denies coverage for Ozempic, Wegovy, and Mounjaro due to high costs, restrictive policies, and complex approval processes. These drugs, used for managing diabetes and weight loss, are expensive - costing over $1,000 per month without insurance. Despite their proven benefits for conditions like PCOS and obesity, many patients face challenges such as:

- Formulary Exclusions: Some insurance plans don’t include these medications, especially when prescribed for weight loss.

- Medical Necessity Requirements: Insurers often demand detailed documentation, like BMI records, proof of comorbidities, and evidence of failed alternative treatments.

- Prior Authorization and Step Therapy: Patients may need to try cheaper drugs first or repeatedly justify their need for these medications.

Even when covered, the process can be time-consuming and approvals are often temporary. Many patients stop treatment due to cost, leading to weight regain and health setbacks. Alternatives like telehealth services offer lower-cost options (e.g., $199/month for Oral Semaglutide) without insurance hassles, providing a practical pathway for those denied coverage.

Will Insurance Cover Wegovy? Here’s How to Get Approved 💡

Why Insurance Companies Deny Coverage

When it comes to medications like Ozempic, Wegovy, and Mounjaro, insurance companies often deny coverage for three primary reasons. Knowing these reasons can help you navigate the approval process more effectively.

Medication Not on the Insurance Formulary

One of the most common reasons for denial is when a drug isn’t included in your insurance plan’s approved list, or formulary. For example, only 1% of ACA Marketplace plans cover Wegovy, compared to 82% that cover Ozempic. This difference stems from how insurers classify these drugs - Wegovy is often labeled as a lifestyle drug for weight loss, while Ozempic is approved for treating type 2 diabetes, making it more likely to be covered.

Federal law further complicates the situation by prohibiting Medicare from covering medications prescribed solely for weight loss. Even a detailed note from your doctor may not override a formulary exclusion. As the NiceRx Editorial Team explains:

"If Wegovy is excluded from your insurance plan, a prior authorization will not help."

However, there’s been a shift. Some Medicare Part D plans have started including Wegovy for patients at cardiovascular risk following its FDA approval in 2024. That said, it’s still not available for general weight management. Beyond the formulary itself, missing or insufficient documentation can also lead to coverage denials.

Lack of Medical Necessity Documentation

Even if a medication is on the formulary, incomplete or missing documentation of medical necessity can result in a denial. For example, a body mass index (BMI) of 30 or higher is typically required, and the absence of recent BMI records could automatically disqualify a claim.

Off-label prescribing adds another layer of complexity. When doctors prescribe medications like Ozempic or Mounjaro for weight loss instead of their approved use for diabetes, insurers tend to scrutinize these claims more closely. Cody Midlam, Director at Willis Towers Watson, highlights this trend:

"What's really resulted in kind of a more heightened focus on prior authorization for the diabetes GLP-1 drugs is the increased volume from off-label prescribing for weight loss."

In fact, around 30% of physicians report frequent denials of their prior authorization requests. This makes meeting prior authorization requirements an even bigger challenge.

Prior Authorization Requirements Not Met

Prior authorization is often a significant barrier to getting coverage. A full 74% of large employer-based health plans require prior authorization for diabetes patients seeking GLP-1 medications. Insurers frequently require patients to undergo step therapy, meaning they must first try lower-cost alternatives like metformin or phentermine and demonstrate that these options failed before approving coverage.

The process can be daunting. Physicians must submit detailed documentation, including recent office visit notes, precise BMI measurements, records of past weight loss attempts, and evidence of supervised lifestyle changes. With 93% of doctors reporting delays due to administrative paperwork, Dr. Anne Peters from Keck Medicine explains how these requirements slow down care.

Even when approved, prior authorizations are typically valid for only six to twelve months. After that, patients need to provide updated documentation to prove continued medical necessity. These challenges add to the already significant financial burden for patients.

| Reason for Denial | What Insurers Look For | Common Requirement for Approval |

|---|---|---|

| Off-Label Use | Prescribing diabetes drugs for weight loss | Diagnosis of Type 2 Diabetes |

| Step Therapy | Proof of trying lower-cost alternatives first | Documentation of failure/intolerance to metformin or phentermine |

| BMI Thresholds | Meeting specific weight criteria | BMI ≥30, or ≥27 with a weight-related comorbidity |

| Formulary Exclusion | Whether the drug is included on the plan | Confirmation of formulary status (e.g., employer opt-in for weight loss coverage) |

| Missing Documentation | Complete and updated medical records | Recent clinic-recorded height, weight, and BMI |

How to Overcome Insurance Denials

Getting a denial from your insurance provider doesn’t mean the end of your treatment options. In fact, statistics reveal that 60% to 65% of insurance appeals for GLP-1 drugs are successful. Even better, up to 80% of denied claims are overturned when patients take the time to appeal. Despite these promising numbers, only about 10% to 15% of patients actually challenge a denial. Knowing how to navigate the appeals process can make all the difference.

Filing an Effective Appeal

The first step is to review your Explanation of Benefits (EOB) to pinpoint why your claim was denied. Typically, you have 180 days from the denial notice to submit an internal appeal. To strengthen your case, compile thorough clinical evidence that reflects your overall metabolic health.

Here’s what to include:

- Verified medical records: Provide clinic-verified BMI measurements (not self-reported), lab results for A1C levels (indicative of prediabetes or diabetes), and records of conditions like hypertension, sleep apnea, or cardiovascular disease.

- Medication history: If step therapy is required, include detailed records of medications you’ve tried, along with dates and notes about ineffectiveness or side effects.

- Weight loss attempts: Include a 3–6 month timeline of supervised weight loss efforts, such as participation in programs like Weight Watchers or Noom, gym memberships, or consultations with a nutritionist.

For medications like Wegovy, emphasizing its cardiovascular benefits can help establish medical necessity, especially if you have documented heart disease risk factors.

You can also request a peer-to-peer review, where your prescribing doctor speaks directly with the insurance company’s medical director to explain why the medication is necessary. If your internal appeal is denied, escalate to an external review through your state’s insurance department. Success rates for external reviews hover around 40%–50%.

As GLP-1 advocate Lucas Veritas puts it:

"Getting approval for expensive GLP-1 medications is much more likely on the second or third attempt - if done correctly!"

By submitting well-documented, verified evidence right from the start, you can improve your chances of success and potentially avoid future denials.

Preventing Denials Before They Happen

Taking proactive steps before submitting claims can help minimize the risk of denials. For example, check your insurance plan’s formulary to confirm that the specific medication is covered. If it’s not, you may need to request a formulary exception instead.

Work with your doctor to ensure all required paperwork is accurate and complete. Even small errors - like using the wrong prior authorization form or leaving out ICD-10 diagnostic codes - can lead to denials. Be sure to include precise codes, such as:

- E11.9 for Type 2 diabetes

- R73.03 for prediabetes

- E66.9 for obesity

If renewing an existing authorization, always include your initial BMI from before starting the medication, not just your current weight.

Under the CMS Interoperability and Prior Authorization Final Rule, which takes effect January 1, 2026, insurers must respond to urgent prior authorization requests within 72 hours and standard requests within 7 days. If a delay in treatment could pose serious health risks, request an expedited review for a faster decision.

If these steps and appeals don’t work, there are other ways to access treatment.

Using Telehealth for Affordable Access

When insurance appeals hit roadblocks, telehealth services can provide an alternative. These platforms bypass prior authorization hurdles, formulary restrictions, and lengthy appeals processes, allowing you to begin treatment without involving insurance.

For example, Oana Health offers personalized weight loss treatments, including GLP-1 medications like Semaglutide and Tirzepatide, prescribed by licensed medical professionals. The entire process - from consultation to prescription and home delivery - is handled online, with free shipping included.

Oana Health’s subscription model provides Oral Semaglutide GLP-1 for $199 per month, covering both the consultation and medication[website]. This is a fraction of the $1,300–$1,350 per month retail cost for brand-name Wegovy without insurance. Plus, you can use Health Savings Account (HSA) or Flexible Spending Account (FSA) funds to make these treatments even more affordable.

Telehealth services can be a practical and cost-effective option when traditional insurance routes fall short.

sbb-itb-6dba428

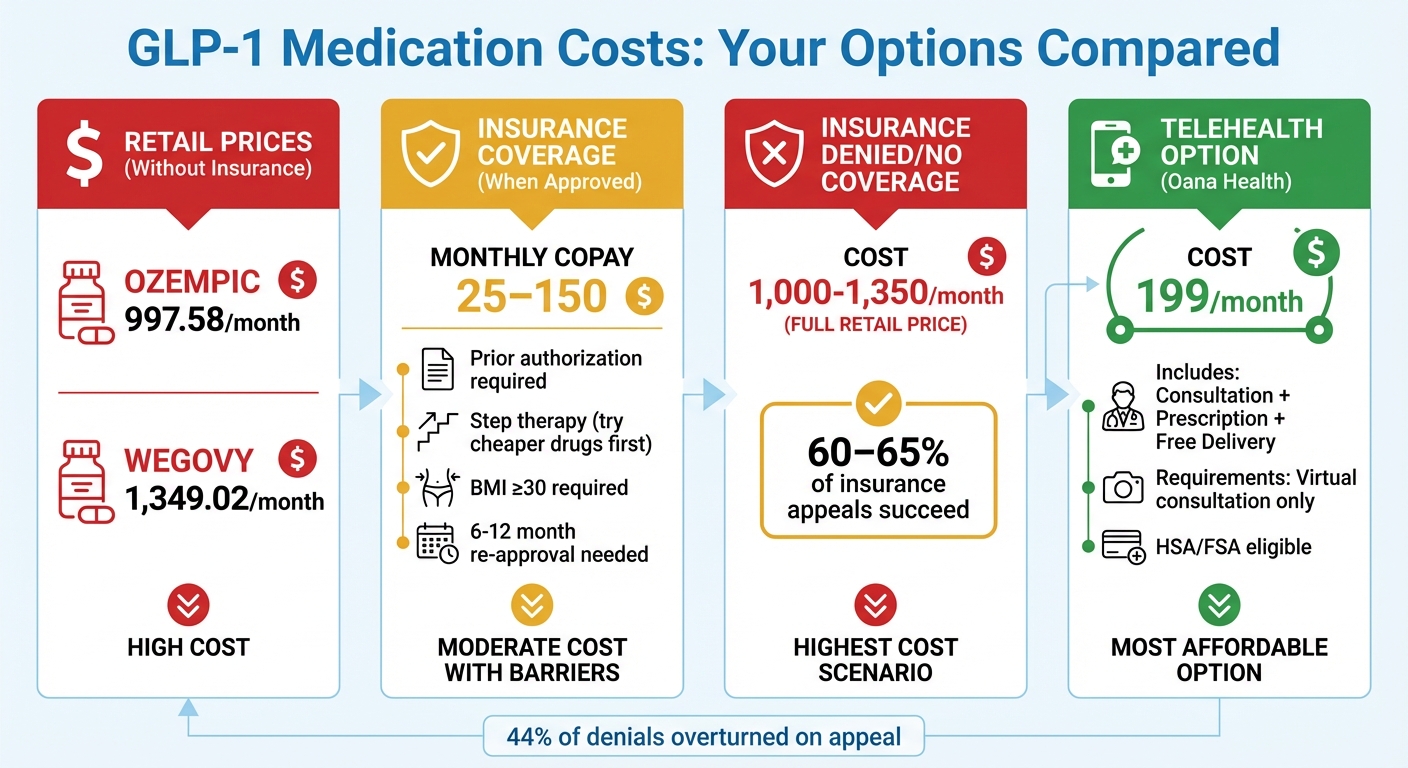

Insurance Costs vs. Telehealth Pricing

GLP-1 Medication Cost Comparison: Insurance vs Telehealth Options

When insurance refuses to cover a medication or imposes hefty deductibles, the retail prices for GLP-1 medications can be overwhelming. For instance, Ozempic costs around $997.58 per month, while Wegovy is priced at approximately $1,349.02. Even with insurance, costs can vary widely, with copays ranging from $25 to $150 after deductibles. For those with high deductibles, however, the full retail price often becomes unavoidable. The table below illustrates these cost differences clearly.

Telehealth services, on the other hand, offer a straightforward pricing model. A flat monthly fee typically includes consultation, prescription, and medication delivery, eliminating the need for prior authorizations or dealing with formulary restrictions. For example, Oana Health provides Oral Semaglutide GLP-1 for $199 per month, covering everything from the consultation to free home delivery. Compared to retail pricing - or even insurance copays after deductibles - this option is much more affordable.

| Option | Monthly Cost | Access Requirements |

|---|---|---|

| Insurance (Approved) | $25–$150 copay | Prior authorization, step therapy, BMI ≥30 |

| Insurance (Denied/No Coverage) | $1,000–$1,350 | Full retail price |

| Oana Health (Telehealth) | $199 | Virtual consultation, direct prescription |

| Direct Manufacturer Programs | $349–$499 | Purchase through company websites |

This comparison highlights the financial certainty that telehealth solutions provide, especially in contrast to the unpredictable nature of insurance coverage. The appeal of telehealth becomes even clearer when considering the frequent changes in insurance policies. For instance, Blue Cross Blue Shield of Michigan announced it would drop coverage for these medications in January 2025, leaving patients to either pay full retail prices or seek alternatives like telehealth.

Dr. Dan Azagury from Stanford Bariatric and Metabolic Interdisciplinary Clinic emphasizes the challenges patients face with insurance:

"It's very common for insurance companies to create these hoops that patients have to jump through."

Telehealth also offers additional flexibility through payment options like Health Savings Accounts (HSA) or Flexible Spending Accounts (FSA), making it an even more accessible choice. For many, telehealth provides a hassle-free path to treatment, free from the administrative headaches and uncertainties of traditional insurance.

Conclusion

Insurance denials for GLP-1 medications like Ozempic, Wegovy, and Mounjaro continue to create unnecessary hurdles for patients who rely on these treatments. In 2025, around 6 million Americans lost insurance coverage for GLP-1 medications due to policy changes, and fewer than 20% of employer health plans currently include coverage for these drugs specifically for weight loss. These restrictions force patients to either pay over $1,300 a month out of pocket or abandon treatment, which can lead to rapid weight regain and worsening metabolic health.

On the bright side, 44% of insurance denials are successfully overturned when appealed, proving that persistence can pay off. To improve their chances, patients should document the medical necessity of the treatment, request peer-to-peer reviews, and explore whether the medication could be prescribed for a covered condition, such as cardiovascular disease.

For those who exhaust all insurance appeal options, telehealth offers a practical alternative. Platforms like Oana Health provide Oral Semaglutide GLP-1 for $199 per month, which includes consultation, prescription, and free home delivery - no prior authorization required. This transparent pricing model removes the uncertainty of insurance coverage and ensures consistent access to treatment.

Weight management isn’t a one-time fix; it requires ongoing care. As Dr. Dan Azagury from Stanford Bariatric and Metabolic Interdisciplinary Clinic explains:

"Having people stop using drugs that have helped them lose weight would be like having someone stop their blood pressure medication after it brought their blood pressure down... It's completely shortsighted. It's the contrary of any treatment goal."

While insurance barriers remain a challenge, patients have options. Whether through appeals or telehealth solutions, there are ways to secure access to these essential medications.

FAQs

Why don’t insurance plans cover medications like Ozempic, Wegovy, or Mounjaro?

Insurance companies often leave these medications off their coverage lists due to their hefty price tag - about $1,000 per month. To cut costs, they might label these treatments as non-essential or cosmetic weight-loss solutions rather than medically required therapies, even though the FDA has approved them for conditions like diabetes or obesity.

On top of that, insurers often set up barriers like prior authorization or strict coverage criteria, making it tougher for patients to access these medications. If you're finding it difficult to get coverage, talk to your healthcare provider about other options or explore the appeals process to help advocate for your treatment.

What can I do if my insurance denies coverage for medications like Ozempic®, Wegovy®, or Mounjaro®?

If your insurance company denies coverage for GLP-1 medications, don’t lose hope - there are steps you can take to challenge the decision and explore alternative solutions.

Start by carefully reading the denial letter to figure out why your claim was rejected. Common reasons include missing medical details, incorrect billing codes, or requirements to try other treatments first. Work with your doctor to address these issues. A detailed letter from your physician explaining the medical necessity of the medication is crucial. This letter should include your BMI, any related health conditions like prediabetes or high blood pressure, and accurate diagnosis codes.

Next, collaborate with your healthcare provider to either resubmit the prior-authorization request or file a formal appeal with your insurance company. Make sure to include all relevant supporting documents, such as lab results and clinical guidelines, to strengthen your case. If your appeal is denied, you can usually request a second-level or even an external review for another chance at approval.

In the meantime, look into manufacturer savings programs or copay cards to help lower your out-of-pocket expenses. For additional support, Oana Health’s telehealth team can help you gather necessary paperwork, draft appeal letters, and connect you with financial assistance programs, ensuring you have the resources to access the treatment you need.

Why do insurance companies deny coverage for Ozempic, Wegovy, and Mounjaro?

Insurance companies frequently reject coverage for GLP-1 weight-loss medications such as Ozempic, Wegovy, and Mounjaro. These denials often stem from reasons like formulary exclusions, strict prior-authorization rules, or disagreements over whether the treatment is medically necessary. Without insurance, these medications can cost more than $1,000 per month, putting them out of reach for many people.

If you've been denied coverage, telehealth services might be a helpful alternative. These platforms connect you with licensed medical professionals who can assess your needs and provide personalized care. Some telehealth providers, like Oana Health, focus on weight management and offer prescription-based treatments shipped directly to your home. This approach may lower costs and make it easier to access the care you need.